“I’ve moved many times in two years, I can’t remember how many times I’ve moved, I keep moving just to find a house I can afford to pay for,” said Ziqin Jiang, an international student from the University of New South Wales who has lived in Sydney for many years.

“I was living in wolli creek, 1000 AUD a week for one person in a 3b2b house, I’ve now moved further away from my school in Chippendale, but the rent is relatively cheap,” he said.

“The street I live in is narrow – people can hardly walk side by side. The smell of garbage is always there, sometimes there is a strong, odd smell. The houses are packed so close, mostly looking old and losing color. It feels crowded and unsafe,” he added.

“The rent price in Sydney is too expensive. I have a twin brother who lives in Canada, studying in Vancouver. His rent is about 1500 per month, not per week, ” Keyu Liu said, a 21-year-old psychology student living in Sydney.

As a landlord, Liu intended to rent out his one-bedroom, one-bath apartment in Zetland for about $1,000 a week when he no longer lived in Sydney.

Liu said that he would opt to relocate to another city or country, like Vancouver, to live with his brother if he was required to pay AUD $1,000 a week in rent as a tenant rather than a landlord.

The average price of a one bedroom in New York is at $3,989 a month and a two bedroom is at $5,392. New York rents are still higher than Sydney’s due to the exchange rate, but Sydney seems to be catching up.

Many students renting in Sydney indicate that the city’s rental market has become unreasonable.

A first year USYD student Chaoran (Claora) Zhou, lived in a student flat. She said the rent in Sydney was a bit high before she came to Australia. But she thought her rent was adequate compared to the rent of her other friends in Sydney.

“When you consider the price for the same type of room, the rent in the Sydney area still seems unreasonable.

“There are a lot of hidden agent fees and service charges, and with the competitive market, the rent has gone up beyond its actual value.

“Most of my classmates live in the student apartments provided by the school. Some of them pay between 450 and 700 Australian dollars a week, but that doesn’t include utilities,” she added.

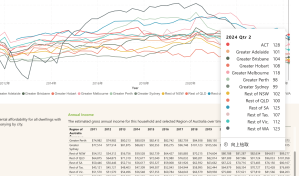

A typical student share house in Greater Sydney has a RAI score of just 76, meaning students spend 39% of their income on rent, well above the 30% affordability threshold. This level of rental stress is classified as “Severely Unaffordable”.

With high rents, short lease periods, and added fees, many students are forced to budget tightly. “Paying rent every two weeks really reminds you to be frugal,” Zhou said.

“I do know some classmates who have to move around a lot because of short lease periods and stuff with their landlords,” she added.

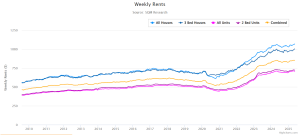

Before the outbreak, weekly rents in Sydney increased slowly from around $475 in 2010 to about $600 by early 2020, and they are still rational.

After the outbreak there was a little dip, but soon rents began to soar. This rapid growth continued for 2 to 3 years, and by 2024, combined rents had reached the highest level — about $850.

RAI = (Income/qualifying income⁴)*100

Low-income households are in housing stress if they spend more than 30% of their income on rent. In the RAI, any score below 100 means the household is likely spending too much on rent and is at risk of housing stress.

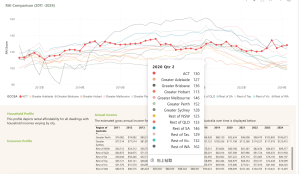

According to SGS Economics & Planning, RAI from 2020 to 2024 shows a steady drop in rental affordability across most of Australia. For example, Greater Sydney’s RAI score in Q2 fell from 128 in 2020 to 99 in 2024.

Rental affordability in Sydney has worsened sharply from 2020 to 2024. In 2020, renting was still affordable for many households, but by 2024, costs had reached the official threshold for housing stress.

This change is mainly due to rent increases outpacing income growth, rising demand, limited housing supply, and broader economic pressures.

Lower-income renters are hit the hardest, with many spending far more than 30% of their income on rent. Groups like single parents and pensioners are under severe stress.

The situation highlights the urgent need for more affordable housing and stronger rent controls to stop things from getting worse.

Zhou said that the tight housing supply was a big problem for low-income and marginalized groups. “It makes it hard for them to stay in the city. It also limits their opportunities and squeezes their living space.

“If this keeps going, the gap between urban and rural areas might get even bigger,” she added.

Asked whether the government or housing organisation should intervene in the market, Zhou said: “I think the government should step in to some extent. If we rely solely on the market, it can lead to resource imbalance and a lack of transparency.

“The government could consider capping rent prices in certain areas to prevent unreasonable hikes. It might also help to offer some housing subsidies, especially for low-income people who are trying to build a life in the city,” she added.

Asked whether the government should intervene in the market, Liu said there was something the government could do but not much.

“I think for students who want to study in Sydney, maybe they can choose another city or country to study in,” he said.

Please feel free to leave comments below. Your thoughts are really important to us!

Be the first to comment