Hot market and rising rents—problems beyond tenants

Since the beginning of 2025, reports on Sydney’s rental market have continued to rise, but the content often focuses on the negative. Rent bidding is frequent, house-inspecting people fill the streets, and the exaggerated rent increases in popular areas are also daunting. The public always thinks only tenants are victims of this crisis, but is that true?

Although tenants are pitiful, the plight of more landlords and agents is ignored. Under the high rent, there is a situation where many people find it difficult to make a living. The unreachable balance of income and outgo, the pressure of policies and public opinion, also make this group part of this panic.

As a little-known aspect of the crisis, this article turns the focus to a landlord and a rental agent, using their stories to reveal a more complex reality—the negative impact of this crisis also hurts those who drive the market, and no one can be identified as a “survivor.”

Landlord’s efforts to balance

Joshua Wong has been a landlord in Zetland for many years. His two-bedroom apartment has been rented out since it was renovated. International students have always been his main customers, mostly because of the living and transportation advantages of this area. After careful evaluation, he raised the rent to 1,300 dollars this year compared to 1,100 dollars two years ago.

This increase seems fierce, but for Wong, he has not gained much. Since last year, the increase in strata fees, insurance, and council rates has been faster than the legal increase in rent. Although he does not need to consider repaying the loan, these “hidden increases” always make him worry whether he is on the verge of breaking even.

Based on a policy adjustment released by NSW Fair Trading in 2024, the time for landlords to increase rents is stipulated to be once every 12 months, aiming to further protect the rights of tenants and provide them with predictability of rent adjustments. Wong’s attitude towards this policy is intriguing. He highlighted a significant hidden danger: many landlords must pay bills adjusted quarterly.

“People look down upon landlords,” he said. “Many landlords will be in a difficult situation where their income is not enough to cover their expenses.”

During this crisis, the public’s attitude towards landlords is contemptuous, believing that they are greedy. Wong is frustrated by these comments, in fact, he believes that the ethics and careful planning in his rental behaviour meet social responsibilities. Therefore, he will not give up his identity as a landlord, but at the same time he is worried about the deepening of the current situation. “Although it is still maintainable now,” he said, “I really can’t predict whether a worse situation will happen in the future.”

The dilemma of rental agents

Since becoming an independent rental agent in early 2024, Rainzo Liu has increasingly felt that she has taken on the additional responsibility of a “mediator”. Although the rental market seems to be booming, the difficulty of real estate agents’ work has also been magnified to a certain extent when facing many anxious customers and stressed landlords.

She said that since the beginning of the year, few properties in the inner city have been listed for more than a week, and there are many cases where more than a dozen applicants are competing for the same property. “The housing crisis has a big impact,” she said. “Tenants are well prepared, but not everyone is lucky.”

“People think that landlords have a greater say in this market, but this is not always true,” Liu explained. “The economic pressure makes the life of landlords less easy than that of tenants.” Properties for investment purposes are declining sharply, and many landlords still have the need to repay their loans, which has become an important factor when they need to weigh the amount of rent.

For Liu, the increase in workload did not bring her satisfaction. On the contrary, coordinating the relationship between the two parties of the rental is far more complicated than imagined.

“I now spend more time calming them than closing deals,” she said.

“If this problem continues unchecked, the negative feedback from the market will hurt everyone involved even more.” She pointed out that filling the long-standing investment gap in affordable housing is the key to solving the housing crisis, rather than making other policy adjustments.

A disordered market and system

The stories of Wong and Liu represent the broad will of their respective groups, which is thought-provoking. It seems that the rental market does not favour either party. The difficulty faced by tenants is obvious, but landlords are also struggling on the boundary line of balancing income and expenditure. Rental agents have to work hard to bridge the differences between the two sides, which makes them nervous.

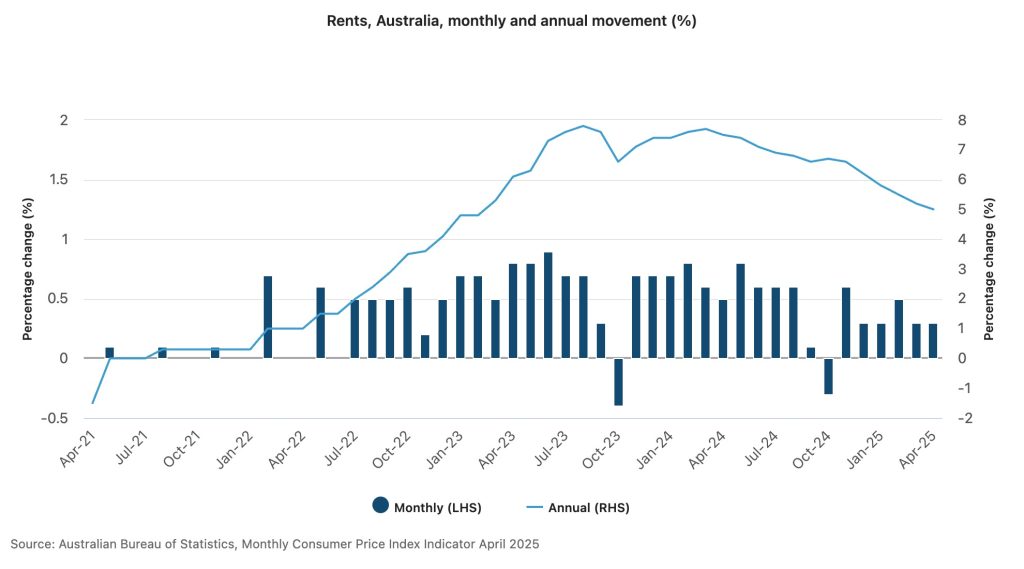

The huge gap between reality and policy was expressed by both. The seemingly reasonable policy of limiting the time for rent increases is causing greater market fluctuations. At the same time, the latest data from the Australian Bureau of Statistics shows that rental prices are still at a historical high, up 5% in the past year. This shows that even with adjustments at the policy level, the pressure faced by landlords and tenants has not been significantly eased.

Moreover, both of them expressed disappointment with public opinion. The society blames the landlords for the crisis, and real estate agents are also criticised. But in fact, their respective duties are also controlled by market trends, and the right to speak has never been in their hands.

“Everyone is doing their part,” Liu said. “If things get worse in the future, we won’t be able to escape unscathed.”

The two agreed that if the disordered market structure does not undergo new changes, the pressure on each participant will not be relieved.

Be the first to comment