Story topic and angle

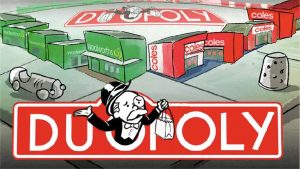

When it comes to Australian supermarkets, the two big ones, Coles and Woolworths, come straight to the mind of many people, as they collectively control about 65-66% of the grocery market in the Australian market, creating a duopoly. According to the ACCC report, grocery prices have largely risen in line with wages between 2018 and 2021. However, by the end of 2022 and the beginning of 2023, grocery prices have risen more than twice as fast as wages and both major supermarkets have seen their profits and margins increase in recent years.

This single market structure has serious implications for competition, pricing, suppliers and consumers, with limited competition giving the two major supermarkets the power to set prices as they please, leaving consumers with no choice. This FEATURE will focus on the impact on consumers, portraying the passive position of consumers in the context of the duopoly, analysing the causes and discussing solutions in the context of the recommendations and policies put forward by the ACCC and government.

Target group

The target audience for this feature is the average Australian consumer concerned about the cost of living and fairness in the marketplace, particularly those who regularly shop at large supermarkets such as Coles or Woolworths. This group often feels powerless in the face of rising prices, and through this article, they can learn about the reasons behind price rises and explore solutions.

Suggested Interviewee

I will try to interview ordinary consumers and representatives of consumer rights organisations who often go shopping in supermarkets. On the one hand, ordinary consumers will be able to talk about the actual impact of rising prices on their daily lives, reflecting the plight of consumers who are in a passive position in the market. On the other hand, the representatives of consumer rights organisations can analyse the phenomenon from a professional and data perspective, revealing the structural problems of the market and the inadequacies of the existing regulation, and providing strong suggestions for solutions.

Online Delivery and Publication

In the online delivery setup of this feature, a combination of text and images, charts and graphs will be used to convey key information in a more intuitive way. Hyperlinks will also be added to the articles to supplement background information and extend the reading to help users understand the content more fully.

This article will be posted on The Guardian Australia, as this platform regularly covers issues related to corporate power, economic inequality and consumer rights. Guardian Australia aims to reach a broad audience, and with around a third of Australians visiting the site each month, it is possible to reach a wider audience with a subject that is relevant to the public.

Source of information

The topic has strong news value, the angle focuses on the passive situation of consumers under the two supermarket monopolies, Coles and Woolworths which shows clear direction. Moreover, the whole text is supported by strong official data. However, the interview target of the average Australian consumer who regularly shop at large supermarkets is too broad. It’s better to focus on the more densely populated areas in Sydney, such as Zetland, Burwood and other international students’ residential areas, Also,It is recommended to use a short video format to present consumers’ reactions in a real-life shopping dilemma scenario to enhance reader empathy in a feature story.