Watching footage from the Shanghai Auto Show, one thing was unmistakable—China isn’t just leading the EV revolution; it’s accelerating far beyond the competition. The fusion of AI, cutting-edge battery technology, and seamless software integration has produced vehicles that feel like a leap into the future. Gone are the days when luxury brands like Porsche and BMW dominated the spotlight, however, Chinese automakers like Xpeng, BYD, and Xiaomi are commanding attention. The automotive stage has shifted, and the global hierarchy of power is being rewritten in real time. This can be seen from the ABC news that BYD’s latest full-year financial results has surpassed Tesla’s.

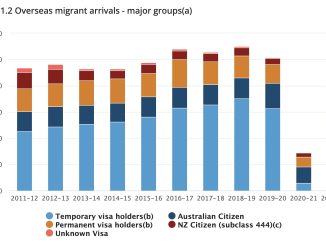

According to EV Central, the Tesla Model Y held its position as Australia’s best-selling EV in 2024, but brands like BYD, MG, BMW, and Volvo are rapidly gaining ground, signaling a shift in the market. With Chinese EVs becoming a familiar sight on Australian streets, Australian citizens have unprecedentedly trusted and purchased Chinese cars not just BYD but also a wave of emerging contenders like Cherry and Kis, it’s fair to say Tesla’s dominance faces an uphill battle. The momentum continues, with brands like Zeekr and Geely entering the Australian market in 2024, preparing for an even stronger presence in 2025.

Meanwhile, Australia’s EV development still lags behind China’s, making the advancements showcased at the Shanghai Auto Show feel almost surreal in comparison. While the Australian government is gradually pushing EV adoption through policy incentives aimed at reducing emissions, China’s transition has happened at an unprecedented pace, which is driven by robust government support and aggressive innovation.

The gap between the two markets underscores the growing influence of Chinese automakers, highlighting how rapidly the global EV landscape is evolving. As their presence expands internationally, Chinese automotive enterprises must deepen their understanding of EV adoption and consumer expectations in new markets.

Having already navigated the challenges of infrastructure development and widespread EV integration at home, they bring invaluable experience in addressing the concerns of potential buyers. From charging networks to affordability, their ability to preempt and solve key barriers could prove instrumental in shaping the next phase of Australia’s EV transition.

Base on these fundamental services can be achieve among the many Chinese brands vying for a foothold in Australia’s growing EV market, some of them even turn to growth luxury EV market, for example, Zeekr stands out with its premium approach. With a five-to-six-year global track record and a recent six-month presence in Australia, the brand is strategically positioning itself through motor shows and social media campaigns. The aim? To challenge long-standing perceptions and carve out a reputation for luxury, innovation, and comfort.

Despite lingering stereotypes surrounding Chinese automakers, Zeekr is challenging expectations with cutting-edge technology and premium design. The brand has positioned itself as more than just another EV contender—it’s redefining perceptions of luxury and innovation in electric mobility.

Zeekr’s sales manager, Leslie, is confident in the brand’s ability to win over Australian consumers, citing overwhelmingly positive customer feedback. “They’ve test-driven other brands, but when they come to us, the first thing they say is how comfortable the ride is. The cabin noise is incredibly quiet, and yet the technology is just as advanced—self-parking, heads-up display, and an immersive sound system that rivals the best in the industry.”

Beyond sleek interiors and high-tech features, Zeekr’s strategic entry into Australia aligns seamlessly with the country’s evolving EV policies, positioning itself to meet the surging demand for electric mobility. “Zeekr is, in a way, leading the EV market toward a more premium standard,” said Leslie, the brand’s sales manager.

With an increasing number of Chinese EV brands making their mark, Zeekr’s presence signals a broader industry shift—one where Australian consumers are no longer just considering Chinese EVs but actively embracing them as premium alternatives to legacy brands. At the same time, the perception of Chinese products is undergoing a transformation. No longer confined to the outdated “cheap” label, Chinese automakers are rapidly evolving into formidable industry players, capable of delivering high-quality, technologically advanced vehicles that meet the expectations of even the most discerning buyers.

Zeekr is just one of many ambitious Chinese automakers making waves in Australia. I had the opportunity to attend the launch of the Geely EX5 at Luna Park—a spectacle that underscored the growing curiosity surrounding Chinese EVs. The atmosphere was electric, with local attendees eagerly engaging in the event, exploring the car up close, and asking questions to better understand its features. As Geely stakes its claim in the Australian market, the enthusiastic response at Luna Park signals that Chinese brands are no longer just newcomers but serious contenders in the country’s evolving EV landscape.

Chinese EV makers are rapidly reshaping Australia’s automotive landscape, bringing advanced technology, affordability, and premium quality to a market long dominated by legacy brands. From the Shanghai Auto Show’s futuristic vision to Geely and Zeekr’s strategic expansion, the presence of Chinese automakers is no longer speculative—it’s a reality Australians are actively engaging with.

Looking ahead, the influence of Chinese EVs will only grow as models like Zeekr’s luxury offerings and Geely’s affordable yet high-tech vehicles continue to gain traction. Government incentives and shifting consumer preferences will further accelerate adoption, challenging Tesla’s dominance and pushing traditional automakers to innovate.

Ultimately, Chinese EVs aren’t just entering the Australian market—they’re transforming it. With advanced technology, aggressive pricing, and a willingness to adapt, they’re poised to redefine the automotive hierarchy. The question is no longer “if” Australia will embrace them, but “how fast” the shift will take place.

Be the first to comment